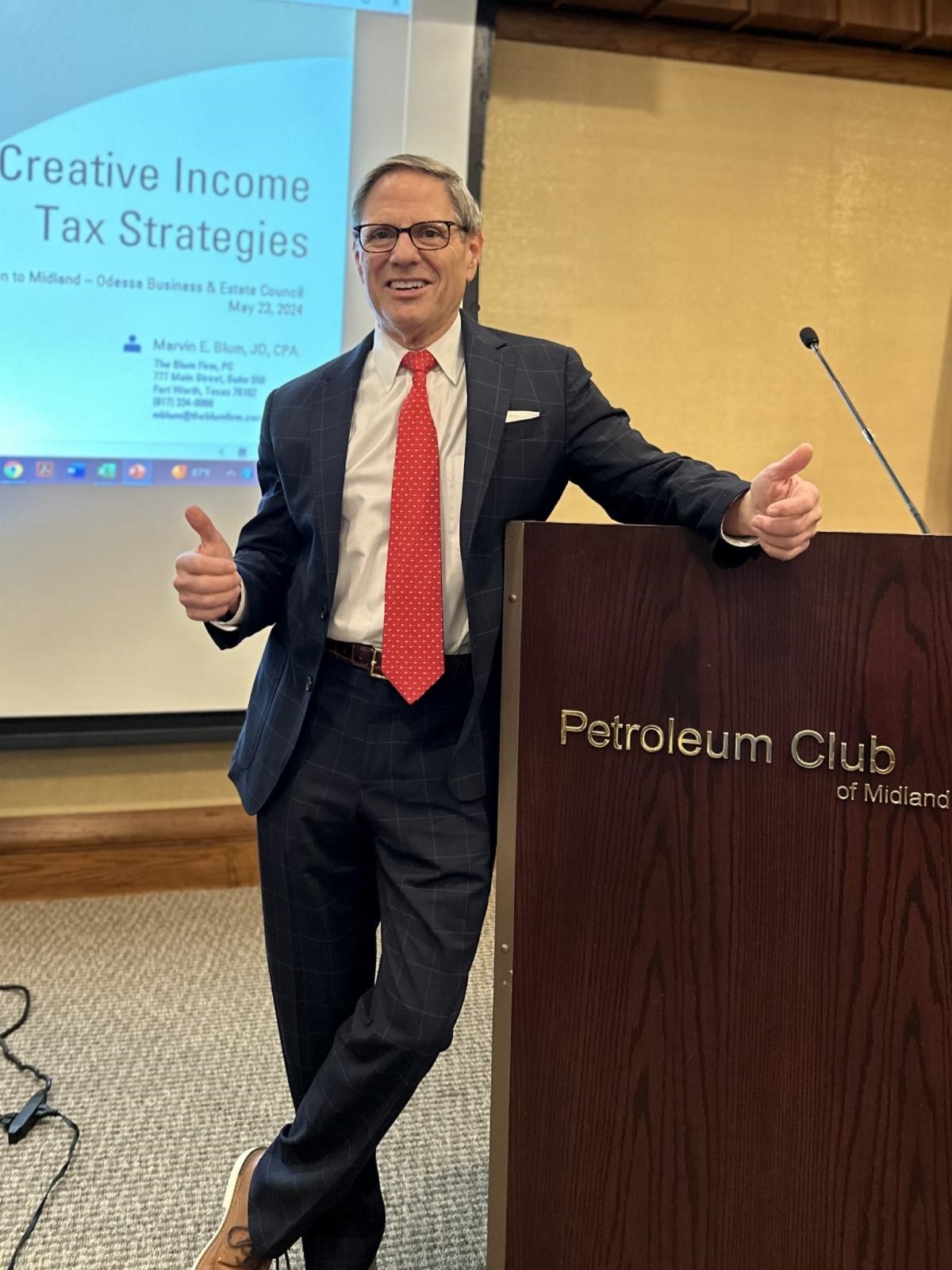

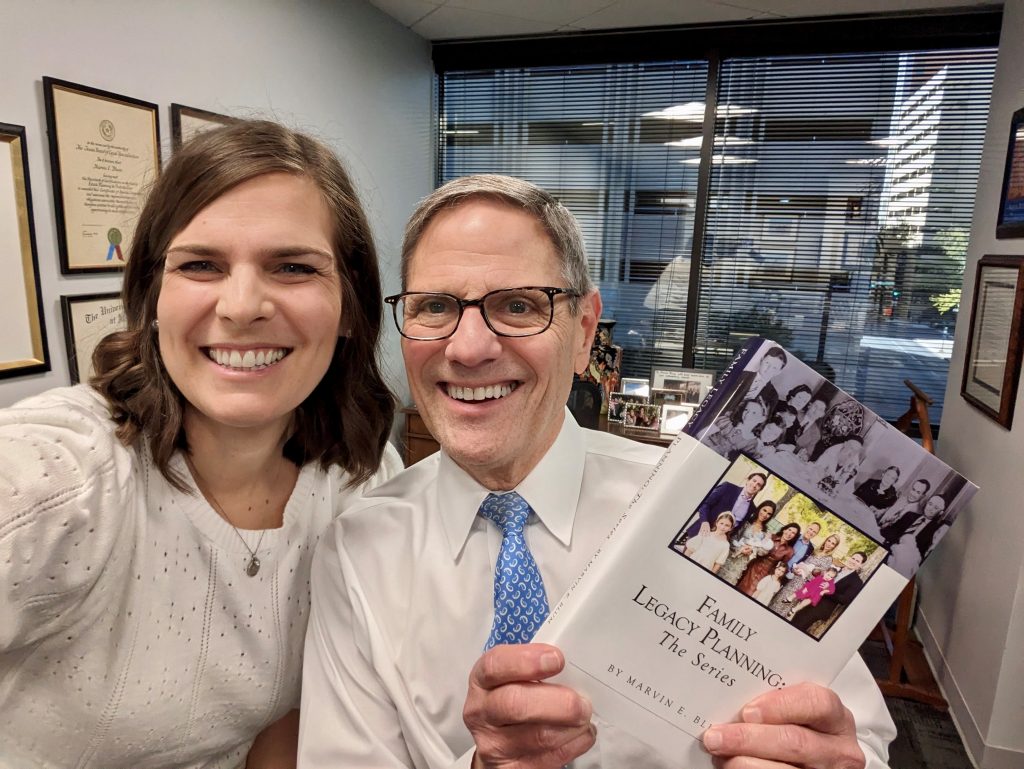

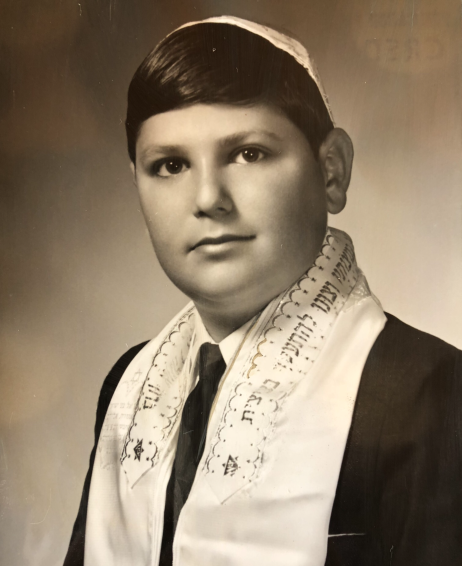

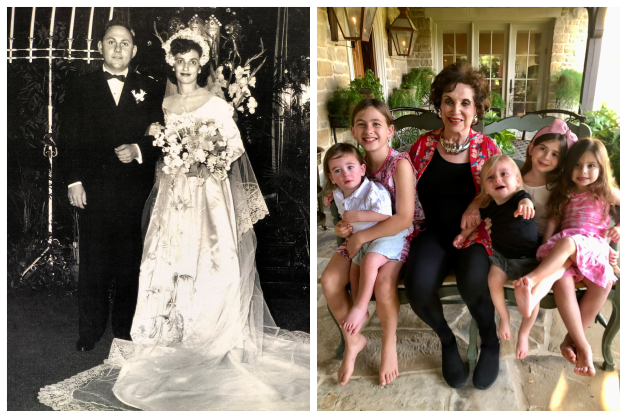

MARVIN E. BLUM is an attorney and CPA based in Fort Worth, Texas. He is Board Certified in Estate Planning and Probate Law and is a Fellow of the American College of Trust and Estate Counsel.

Mr. Blum founded The Blum Firm, P.C. over 40 years ago. The firm specializes in estate and tax planning and the related specialties of asset protection, business planning, business succession planning, charitable planning, family legacy planning, fiduciary

litigation, and guardianship. The Blum Firm has grown to be one of the premier estate planning firms in the nation, known for creating customized, cutting-edge estate plans for high-net-worth individuals.

Mr. Blum serves on the Editorial Advisory Committee for Trusts & Estates magazine. He is Treasurer for the Texas Cultural Trust.

Mr. Blum earned his BBA (Highest Honors) in Accounting from The University of Texas and received his law degree (High Honors) from The University of Texas School of Law.

Estate Planning Checkup: Top 10 Questions to Ask Your Client

It’s a whole new world of estate planning—a current high estate tax exemption that soon sunsets in half, the prospect of higher capital gains rates and/or the loss of stepped-up basis, larger inheritances, complicated family dynamics, rising rates of divorce and litigation, electronic data. The list goes on and on. Your daddy’s way of doing estate planning doesn’t work anymore. Here’s a list of questions you should ask every client. The answers almost always lead to a need for a serious estate planning update.

1. Do you own anything in your name (other than retirement accounts)?

2. After you’re gone, will your retirement assets be protected?

3. If you died right now, would your children’s inheritance potentially become divisible upon a divorce?

4. Have you taken advantage of the doubled estate tax exemption? (“Use it or lose it.”)

5. Can you have your cake and eat it too (i.e., how can you get assets out of your estate but still have access and control)?

6. Do you have any low basis assets? (If so, you may need some “upstream” planning.)

7. Do you love your grandkids equally? (Consider a life insurance policy that goes to them per capita instead of per stirpes.)

8. Do you have a “Red File”?

9. Do you have a business succession plan in place?

10. Are you worried an inheritance will ruin your children? (Consider a FAST solution to legacy planning—the Family Advancement Sustainability Trust.)

1 Do you own anything in your name (other than retirement accounts)?

› If assets are titled in your name, it generally reveals two things:

• Most likely, the assets are exposed to claims of creditors.

• If the estate is above the exemption, the assets will likely be exposed to a 40% estate tax.

› Step 1 – Examine each asset to determine if it is “safe” or “risky.”

• Risky assets (such as real estate or oil and gas) have “inside” liability exposure because they can give rise to claims.

• Address inside liability exposure by putting an entity wrapper (family limited partnership, limited liability company, or corporation) around each risky asset, so creditors can only reach the one risky asset and can’t reach other assets outside the entity wrapper.

› Step 2 – Address “outside” liability exposure, protecting safe and risky assets from being exposed to the owner’s personal creditors (such as a tort creditor).

• By transferring safe assets and all risky asset entities into a family limited partnership (“FLP”) or limited liability company (“LLC”), outside creditors can’t reach the assets and are limited to a charging order.

• Note that this protection doesn’t apply to stock in a corporation, as personal creditors of the stockholder can seize and vote the stock.

› Step 3 – Transfer the FLP or LLC units to an irrevocable trust for another layer of asset protection and to remove assets from the taxable estate.

2 After you’re gone, will your retirement assets be protected?

› What is the best way to pass down the retirement plans? Naming the children as outright beneficiaries of the plan may not be ensuring the best protection of the retirement account.

› Naming a trust as beneficiary instead:

• Places the retirement benefits out of the reach of creditors of the trust’s beneficiaries. Creditors’ claims or judgments from lawsuits will not place the retirement accounts in jeopardy of being seized.

• Makes the assets held in the trust unreachable in the event a beneficiary of the trust goes through a divorce.

• Any retirement funds remaining in the trust when the beneficiary of the trust dies may not be subject to estate taxes.

› Prior to the Setting Every Community Up for Retirement Enhancement Act of 2019 (“SECURE Act”), when a child or spouse was named as beneficiary of an IRA, the Required Minimum Distributions (“RMDs”) could be calculated based on the beneficiary’s life expectancy, up to 58 years, thus “stretching out” the payout period. The SECURE Act changed this for most children, imposing a 10-year payout rule, requiring that IRA amounts must be paid out within 10 years of the account owner’s death. (A surviving spouse may still withdraw retirement benefits based on his or her life expectancy.)

› In addition to a surviving spouse, the 10-year payout rule does not apply to the following individual beneficiaries:

• Disabled individuals.

• Chronically ill individuals.

• Individuals who are not more than 10 years younger than the IRA owner.

• A minor child of an IRA owner (the 10-year period for a minor beneficiary begins when the beneficiary reaches the age of majority).

› If a trust is named as the beneficiary of an IRA, unless the trust meets certain requirements, the payout is subject to a 5-year rule. This rule requires the balance of the IRA to be distributed (and taxed) to the trust beneficiaries within 5 years of the death of the IRA owner.

› Special trusts called Conduit Trusts and Accumulation Trusts (sometimes called “see through” trusts) could be named as beneficiary to gain the asset protection qualities inherent to trusts as well as qualify for a 10-year payout instead of a 5-year payout.

• With a Conduit Trust, payouts received by the trust are immediately distributed to the beneficiary. Under the SECURE Act’s 10-year payout rule, IRA amounts will be paid to the Conduit Trust within 10 years and then distributed immediately to the beneficiary.

• With an Accumulation Trust, IRA amounts received can be held in the trust rather than paid out immediately. So, although IRA amounts must be paid out from the IRA to the Accumulation Trust within 10 years, they can be held in the Accumulation Trust and dribbled out to the beneficiary as needed.

Accumulation Trusts will now be the “go to” technique to gain the asset protection qualities inherent to trusts.

3 If you died right now, would your children’s inheritance potentially become divisible upon a divorce?

› Any asset owned outright by either spouse is “marital property.”

• All marital property is presumed to be community property.

• The burden of proof is on the party claiming an asset is separate property.

• Income from separate property is community property.

› On the other hand, none of the assets that are owned by a properly structured irrevocable trust is marital property. Therefore it:

• Cannot be community property.

• Does not generate community property income.

• Is not divisible upon divorce.

› Strongly urge clients to leave the inheritance to dynasty trusts for the benefit of children and future generations.

› Any asset owned outright by either spouse is “marital property.”

• All marital property is presumed to be community property.

• The burden of proof is on the party claiming an asset is separate property.

• Income from separate property is community property.

› On the other hand, none of the assets that are owned by a properly structured irrevocable trust is marital property. Therefore it:

• Cannot be community property.

• Does not generate community property income.

• Is not divisible upon divorce.

› Strongly urge clients to leave the inheritance to dynasty trusts for the benefit of children and future generations.

4 Have you taken advantage of the doubled estate tax exemption? (“Use it or lose it.”)

› We have a window of opportunity with a doubled estate tax exemption of $11.7 million, but “USE IT OR LOSE IT” before it sunsets in half on December 31, 2025 (or sooner??).

› To lock in the benefit of the doubled exemption, a couple has to transfer $23.4 million out of their estate.

› The $11.7 million exemption is one-half “original” exemption and one-half “extra” exemption. Note that if a couple only transfers a total of $11.7 million instead of $23.4 million (50/50 from each spouse) in an effort to lock in the “extra”

exemption, they’ve actually only used the “original” exemption amount. After sunset, that couple would have zero exemption remaining. To lock in the “extra” exemption amount, each spouse has to transfer $11.7 million.

› Anti-Claw Back Regulation – The IRS issued final regulations providing that the benefit of the temporary increase in the gift and estate tax basic exclusion amount would not be clawed back on the taxpayer’s subsequent death after 2025.

Spousal Lifetime Access Trust

› The most popular way for married couples to use each spouse’s gift/estate tax exemption is for each spouse to create a trust for the benefit of the other because doing so preserves the resources for the spouses’ benefit. This type of trust is often referred to as a Spousal Lifetime Access Trust (“SLAT”).

› Each spouse’s gift would use part or all of their lifetime exemption amount, depending on the amount of assets transferred. Assets held in the SLAT would not be included in either spouse’s estate at death.

› Think of it as a “Lifetime Bypass Trust” for the benefit of a spouse.

› Example:

• Husband and Wife enter into a marital property agreement in which they agree to convert a portion of their community property into two separate property halves.

• Husband creates a trust for the benefit of Wife and funds it with $11 million of his separate property.

• Wife has access to Wife’s SLAT for her needs during her lifetime. After her death, the remaining assets are split into separate trusts for the children.

• At a later date (the more time, the better), Wife creates a trust for the benefit of Husband and funds it with $11 million of her separate property. Husband has access to Husband’s SLAT for his needs during his lifetime. After his death, the remaining assets are split into separate trusts for the children.

• While Husband and Wife are both alive, the married couple retains access to the full $22 million. However, after the first death, the survivor only has access to $11 million. To replace the lost assets, each SLAT could buy an $11 million life insurance policy on the life of the other spouse.

• If Husband dies first, at Husband’s death, Wife continues to benefit from her SLAT, plus her SLAT collects $11 million on Husband’s life, so her access to the full $22 million isn’t diminished when Husband dies. If Wife dies first, at Wife’s death, Husband continues to benefit from his SLAT, plus his SLAT collects $11 million on Wife’s life, so his access to the full $22 million isn’t diminished when Wife dies.

› Note that the two SLATs must be substantially different or will violate the reciprocal trust doctrine.

“Tax Fence” With SLAT Planning

If Only Willing to Gift $11.7 Instead of $23.4 Million

› If a couple decides to only give $11.7 million, make the gift entirely from one spouse and don’t gift-split.

› Compare the outcomes:

• If each spouse gives a gift of half the $11.7 million, after sunset they will have each used all of their “original” exemption and none of the “extra” exemption, so their remaining exemption is zero.

• Instead, if the husband gives the entire $11.7 million, after sunset, the wife will still have her “original” $5 million exemption (adjusted for inflation).

“Use It or Lose It” for a Single Person

› If the single person can part with access, the easiest approach is a gift of $11 million to an Intentionally Defective Grantor Trust (or “DGT”) for the benefit of children or others.

• If the donor needs access, consider having the donor borrow from the DGT on arms’ length terms.

• The donor can retain a swap power to reacquire trust assets for assets of an equivalent value.

• An Independent Trustee could have ability to reimburse the donor for income taxes on trust income.

• Alternatively, to retain access, consider creating a Special Power of Appointment Trust (“SPAT”). The donor makes a gift to a trust for others but gives an independent party a special power of appointment to make distributions to a class of donees that includes the donor. For example, the class of donees could be “the descendants of the donor’s mother.”

5 Can you have your cake and eat it too (i.e., how can you get assets out of your estate but still have access and control)?

Dispel Planning Myths

› Some are hesitant to engage in estate planning for fear of losing control of the assets, losing access to the assets, or losing the flexibility to change their mind. There are some “freeze” planning techniques which allow the client to retain all these things.

• First, the client transfers the assets to an FLP to “squeeze” down the value of assets by the FLP units qualifying for valuation discounts.

• Next, “freeze” the value and lock in the discount by transferring the FLP units to a trust that is outside of the estate, e.g., sales to a Beneficiary Defective Trust (“678 Trust”), gifts/sales to a SLAT, or gifts/sales to a DGT for the benefit of the children.

• Control – Client is president of general partner of FLP; also, can serve as trustee of 678 Trust.

• Access – Notes receivable from sales; client is also beneficiary of 678 Trust or SLATs.

• Flexibility – Special trustee or trust protector provisions; special power of appointment in 678 Trust or SLATs.

› By utilizing a 678 Trust (also called a Beneficiary Defective Trust or “BDT”) in the “freeze” stage, the client does not have to give up control of the assets or give up access to them.

› Why choose a 678 Trust?

• The clients can remain in control.

• The clients can be beneficiaries of the 678 Trust and can continue to have access to the assets for their needs.

• The assets in the 678 Trust are not taxed in the clients’ estates.

• The clients can have a special power of appointment to direct where the assets pass upon their deaths.

• The assets in the 678 Trust are protected from creditors.

678 Trust Basics

› A 678 Trust is established by a third party (such as the client’s parents, sibling, or close friend) with a gift of $5,000.

› The client is the primary beneficiary of the 678 Trust and can receive distributions for health, education, maintenance, and support.

› With careful drafting, the client may also be named as trustee of the 678 Trust.

› The client-beneficiary is given a withdrawal right over the initial $5,000 contribution.

› The trust agreement provides that a Special Trustee has the power to terminate the trust in favor of the client-beneficiary, even after the client-beneficiary’s withdrawal right over the $5,000 gift lapses.

› The 678 Trust technique works because of a “disconnect” between the income tax code and the estate tax code.

• For estate and gift tax purposes, when the client-beneficiary allows the withdrawal right to lapse, the client-beneficiary is not viewed as the grantor of the trust because of the 5 and 5 exception in the estate tax code, and so the trust assets are not includable in the client-beneficiary’s estate.

• For income tax purposes, when the client-beneficiary is given the withdrawal right and when the withdrawal right lapses, the client-beneficiary is viewed as the grantor of the trust, making the client-beneficiary the owner of the trust for income tax purposes. (Note that although the withdrawal right is limited to $5,000, there is no 5 and 5 exception in the income tax code.)

› The clients “burn down” the assets that remain in their taxable estate to pay for living expenses and to pay the income taxes generated by the 678 Trust.

› After the notes are paid off, the trustee of the 678 Trust will make distributions to the clients to cover their living expenses and income taxes.

“Tax Fence” With 678 Trust Planning

6 Do you have any low basis assets? (If so, you may need some “upstream” planning.)

› If the client has appreciated assets, the client should look “upstream” to the client’s parent for obtaining a stepped-up basis, especially if the parent is ailing.

“At the risk of being tactless, the death of a parent, grandparent, or other older relation or friend is a sad enough event without also wasting the opportunity for a significant basis increase.” ~Howard Zaritsky, nationally-known tax & estate planning attorney

› If the client has low-basis assets and the client’s parent has unneeded exemption, the client could gift the assets to a parent outright or, even better, to a trust for the parent and give the parent a General Power of Appointment (“GPOA”) over the assets.

› CAUTION: IRC Section 1014(e) denies the basis step-up if the assets come back to the child or the child’s spouse within one year. This potential limitation may be avoided if the assets pass (i) to a trust for the benefit of the client and/or the client’s spouse with a trustee other than the client or client’s spouse or (ii) to the client’s child or a trust for the child’s benefit.

› Example:

• The client creates a trust benefitting the parent and gifts low-basis assets to the trust.

• In drafting the trust, the client gives the parent a GPOA over the trust assets.

• The GPOA will cause the assets to be included in the parent’s estate under IRC Section 2041(a)(2).

• In the parent’s will, they exercise the GPOA and leave the assets to a trust for the client.

• When the parent dies and the assets come back to a trust for the client, the assets will have a new stepped-up basis (under IRC Section 1014(b)(9)).

• Note that the outcome is the same if the trust is drafted so that if the GPOA is not exercised, the assets pass back to the donor child or to a trust benefitting the donor child. In this case, there would be no need for the parent to even exercise the GPOA.

Upstream Planning: GIFT Appreciated Assets to Parent with GPOA

› What if the client or the parent doesn’t have enough lifetime exemption? Or, what if we don’t want to use up their exemptions? Instead of the client making a gift to the parent, consider a SALE to the parent’s trust.

› Example:

• The client sells low-basis assets to a grantor trust, taking back a note secured by the assets. By selling instead of gifting the assets, the client’s exemption won’t be used up.

• When the parent dies, under IRC Section 2053(a)(4), the assets included in the parent’s estate will be offset by the secured debt owing by the trust. So, the parent’s estate would only increase by the amount of any appreciation on the assets between the date of sale and the date of death, less any interest paid on the note.

• The assets get a stepped-up basis, but the net increase to the parent’s estate is zero (assuming there was no appreciation between the date of sale and the date of death). Therefore, none of the parent’s exemption is used.

Upstream Planning: SELL Appreciated Assets to Parent with GPOA

7 Do you love your grandkids equally? (Consider a life insurance policy that goes to them per capita instead of per stirpes.)

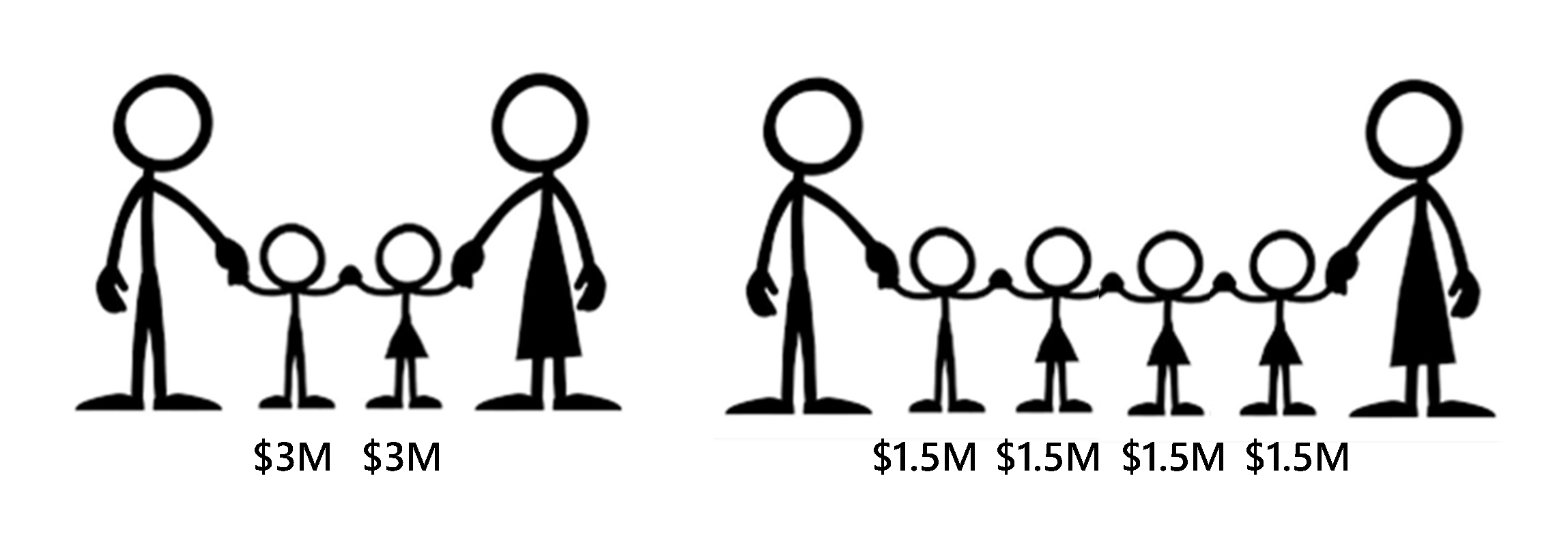

› Do you love your grandchildren equally? With a traditional per stirpes inheritance, grandchildren with more siblings will receive less than grandchildren with fewer siblings.

› Assume Generation 1 (“G-1”) has a son with 2 children, a daughter with 4 children, and a $12 million estate. After G-1 dies, the son and daughter each receive $6 million. However, after the son and daughter (Generation 2 or “G-2”) dies, the son’s children each receive $3 million while the daughter’s children each receive $1.5 million.

› To lessen this blow on the cousins, consider taking out a life insurance policy that goes to all the grandchildren per capita.

› The policy can be on G-1’s life for the benefit of Generation 3 (“G-3”) per capita, paid to G-3 at G-1’s death.

› Or, the policy can be on G-2’s life for the benefit of G-3 per capita, paid to G-3 at G-2’s death. Doing a policy on G-2 instead of G-1 would provide more coverage since G-2 is younger. With this scenario, G-1 can either pay the premiums as a gift or can lend money to G-2 to pay the premiums.

› The rest of the estate plan remains intact. This creates new assets to use for gifting to G-3 without disrupting G-2’s inheritance.

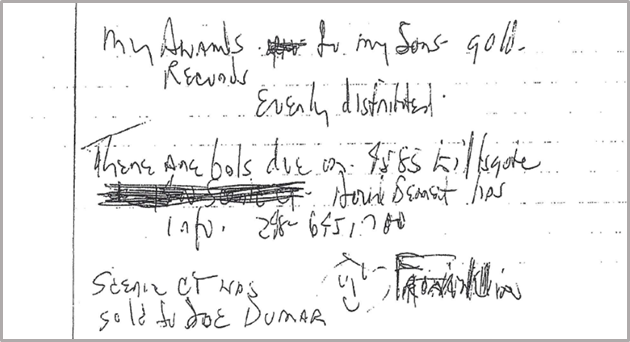

8 Do you have a “Red File”

› Statistics:

• The leading cause of death in the United States is heart disease.

• For two-thirds of women and half of men who die from heart disease, their first symptom was death—not chest pain, not discomfort in an arm, not shortness of breath.

› People in seemingly excellent health can go quickly and unexpectedly. Imagine you died suddenly or become incapacitated. Do those closest to you have all the information they will need?

› Create a “Red File” for what estate planning documents don’t cover.

Section 1 – Centralized File of Personal Information

› Centralized file of personal information, such as key contacts, location of assets, passwords, etc.

› Typically, a spouse, child, or other loved one takes on the role of executor with only part of the instructions they need.

› They may know who is to receive mom’s assets, but what exactly did mom own? How many bank accounts did she use? What insurance policies did she have? Was there a safety deposit box? What bills did she owe? How do I access her email or shut down her social media accounts?

Section 2 – Business Continuity Plan

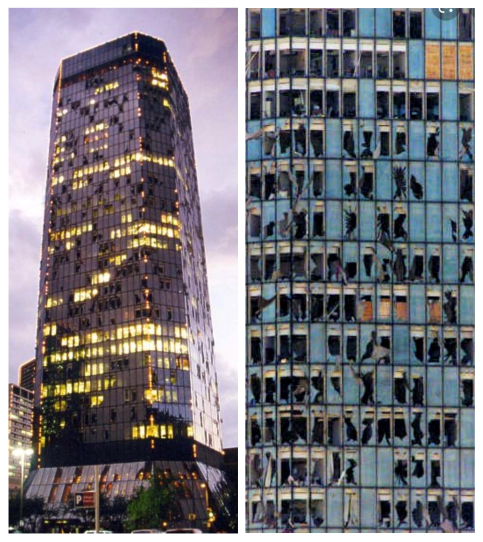

› Business continuity planning (also called business succession planning) is the number one most neglected area of estate planning.

› The estate plan addresses who will own the business but not who will manage it.

› As baby boomers age, many seem to think they’re going to live forever and have done no business succession planning. The problem is even worse for a long held family business, where owners are more emotionally tied to the business and have a hard time being objective. › Provide information on management succession to facilitate the transition when (not if) you are no longer able to manage your business.

Section 3 – Plan for Incapacity

› Create a plan in case of incapacity, including guidance for future care, preferences, and a clear expression of financial intentions.

› Clients typically don’t make preparations for the possibility of becoming incapacitated. In many instances, clients may actually be more willing to discuss preparations for their death than the possibility of incapacitation. This may be because the term “incapacitated” often invokes images of nursing homes and hospital beds. In reality, incapacitation most often comes in the form of cognitive deterioration.

› Many individuals assume a family member will take care of them in the event of incapacity, but few appreciate the number of decisions a guardian or caretaker must make on behalf of an incapacitated person. From housing situations to medical treatment to simple living and eating preferences, without guidance, a family member is left to simply guess at what their loved one wanted.

Section 4 – Legacy Plan

› Aside from money or assets, what do you want to leave behind? A Red File can help you gather information about the legacy you want to leave behind—aside from money or assets.

› Sheltering at home with family during the COVID-19 pandemic has made many of us acutely aware of any communication or family harmony issues.

› The recent increase in the use of video-conferencing services (such as Zoom) has shown us there is no need to put off having the first family meeting until everyone can be in the same room. 41

› Most importantly, once you’ve created your Red File with all of this information, tell someone where it’s kept.

› Be sure to update it periodically.

› Download a copy of our Red File Checklist here: https://theblumfirm.com/2021/Red-File-Checklist.pdf

9 Do you have a business succession plan in place?

› Why is business succession planning such a hot topic?

• As baby boomers age, many seem to think they’re going to live forever and have done no business succession planning. The problem is even worse for a long-held family business, where owners are more emotionally tied to the business and have a hard time being objective.

• According to the Small Business Administration, half of small business owners are over age 50, and statistics show that from now until 2029, 10,000 baby boomers will reach age 65 every day.

• Talk to your business owners. Ask them what’s going to happen WHEN, not IF, they’re no longer running the business.

• Form a planning team (CPA, attorney, financial advisors) and bring all the key stakeholders to the table to develop a plan and implement the succession process.

Weigh the Options

› Before you can start developing a plan, the founder needs to decide whether the company will be passed down in the family or sold.

› There are 3 primary choices in the toolbox when thinking about succession planning:

• Transfer the business to a family member/family members.

• Sell the business to people within the business.

• Sell the business to an outside party.

› When considering transferring the business to a family member/family members…

• What do your kids want? Do they even want the business?

Keeping It in the Family

› Every family is different. There’s no single succession plan that will work for all families. Searching for a solution involves evaluating a toolbox of planning options to find what works best.

› When developing a business succession plan to pass a business down to family members, there are 5 key components of a good plan.

› FIRST, you need to decide the timing—when the change in control of the business should happen. It’s often best to transfer control while the founder is alive so that he can participate in the process and influence the stakeholders. The founder is the “glue” that keeps everyone together and makes the process a smoother transition.

› SECOND, it’s time to start training the successor. To groom a successor, the founder needs to shift from being quarterback to coach. The process of having a successor “ride around in the truck” with the founder may take many years, so it’s important to start early.

› While the successor is being groomed, offer him or her a role as an observer at board meetings. Expose the successor to the process.

• I work with one family business that invites family members to observe board meetings beginning at age 14. They call this the “junior board.” The founder wants the children to understand what the family business does before the children enter college or decide on career paths because it may affect what the child decides to study in college and the child’s choice of a career path.

› THIRD, who will manage the business? The business needs to run like a business and not like a family. You may have to come to grips with the fact that some children aren’t qualified to run the business. (Again, management is a separate concept from ownership of the company.)

› Who will be on the Board of Directors?

• Needs to include someone with hands-on experience in the business world, perhaps with training in management.

› Who will elect the Directors?

• If you have only one class of stock and you leave it in equal shares outright to children (some active and some not), this is a recipe for friction. Instead, consider different classes of stock (such as voting and nonvoting or common and preferred).

• Also consider leaving the stock in trust with a carefully-selected trustee. The trustee needs to be either an objective party or someone who’ll do what’s best for the well-being of the business. When designing the trust, consider naming an independent (or special) trustee with powers to remove and replace the trustee and powers to make certain amendments if unforeseen events arise.

› FOURTH, a good succession plan needs to provide a cash flow for all family members who will own the business.

• If a family business is passed to children in equal shares and only some of the children work in the business, the other children may not receive a cash flow from the business. The non-active children may push for the business to be sold so they can see a cash flow.

• Are there assets that you can divide up and distribute out to the owners? For example, does the company own real estate that can be separated out from the operating business and put in a separate entity, then enter into a long�term lease? This could provide a cash flow for those not employed in the business.

• Life insurance can provide a cash flow for the children who will not receive a salary from the business.

› FIFTH, provide an exit strategy for an owner wishing to sell his share.

• Explore buy/sell arrangements (ideally funded with life insurance).

• Buy/sell arrangements are especially effective in family businesses where family members active in the business can buy out those not in the business. The non-active sibling sells and gets cash. The active sibling buys and gets control.

Selling to an Outside Party

› If the decision has been made that the company will be sold, work to position the company to be ready to be bought when you’re ready to sell.

› Remedy inefficiencies in the business. Optimize the value of the business to maximize the sales price.

› Look at the company through the eyes of a potential buyer:

• Are the business financials in order?

• Will key employees and relationships necessary for the business to continue be retained?

• What are the intangible values of the company (key employees, internal processes, reputation for quality)?

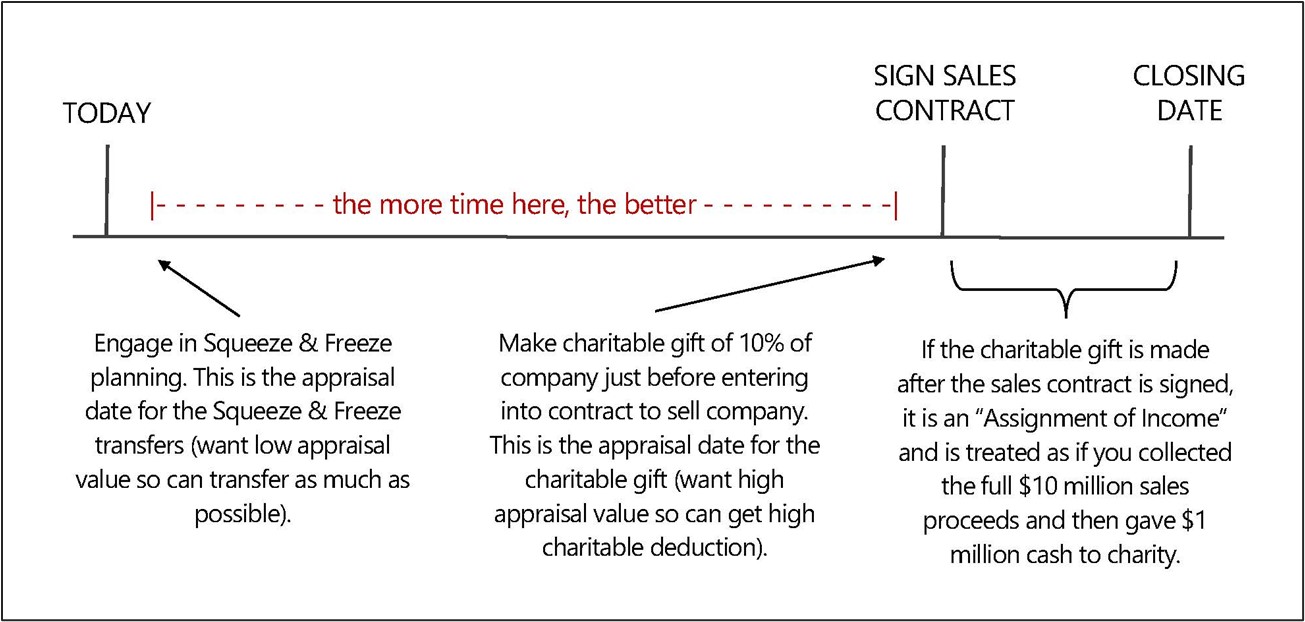

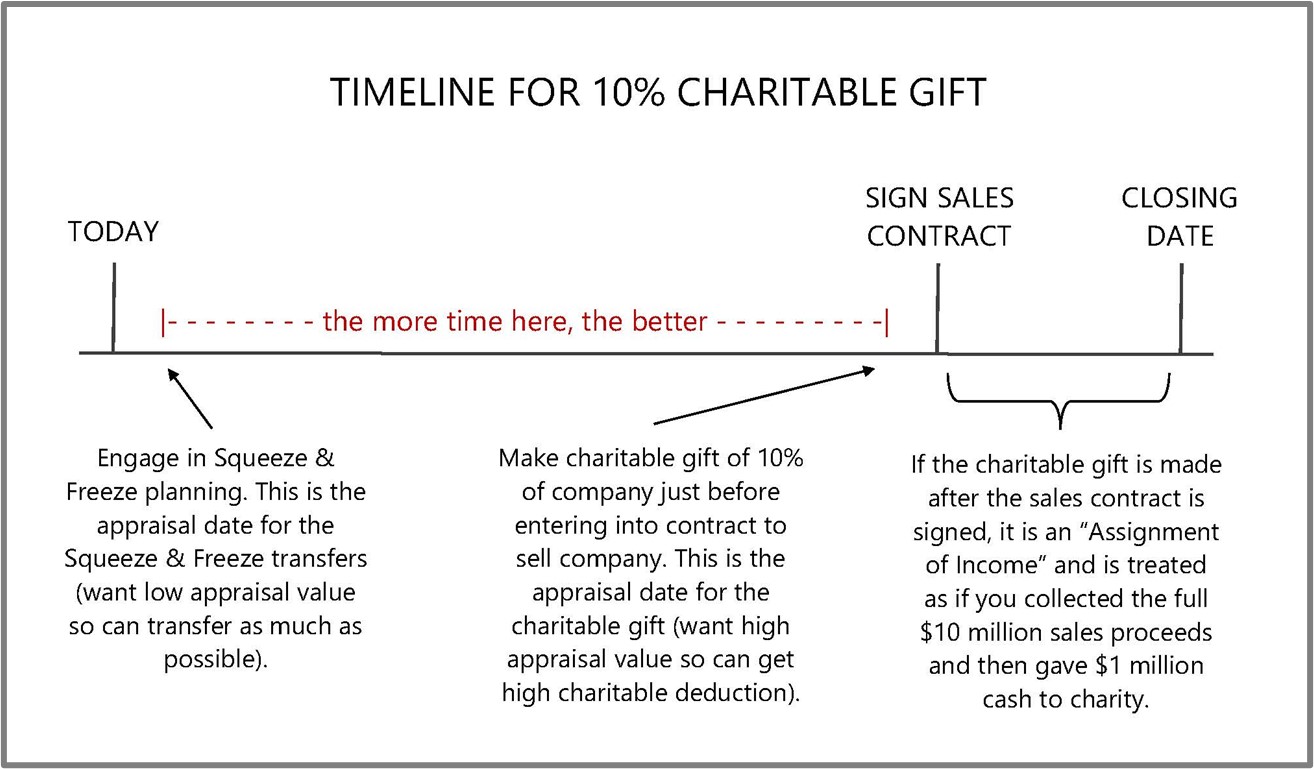

Tax Planning Before the Sale

› Tax planning before a sale is about minimizing taxes and therefore maximizing the amount of the sales proceeds the family actually gets to keep, after paying income tax and estate tax.

› To minimize estate tax, transfer the business to trusts at a time when it qualifies for the maximum amount of valuation discounts.

› The earlier you start, the greater the discount, and the more estate tax you can save. 51

› Estate Freeze Planning

• Estate freeze planning “freezes” the asset’s value for estate tax purposes by moving future appreciation to a pocket that is outside of the taxable estate.

• For closely-held business owners, the largely illiquid business is often the most valuable asset in the estate. Without proper planning, the business may have to be sold to pay the estate tax. The client may have intended for the business to stay in the family but didn’t put a plan in place for that to be possible.

• A Section 6166 long-term payout of estate tax is just putting off the problem.

• Even if the client is currently under the federal estate tax exemption level, many are growing their estates and their net worth will exceed the exemption level at death.

• Are you sure you know how the IRS will value the business? It can be difficult to determine the value of a closely-held business. The client may believe his estate is below the estate tax exemption level, but the IRS may not.

10 Are you worried an inheritance will ruin your children? (Consider a FAST solution to legacy planning— the Family Advancement Sustainability Trust.)

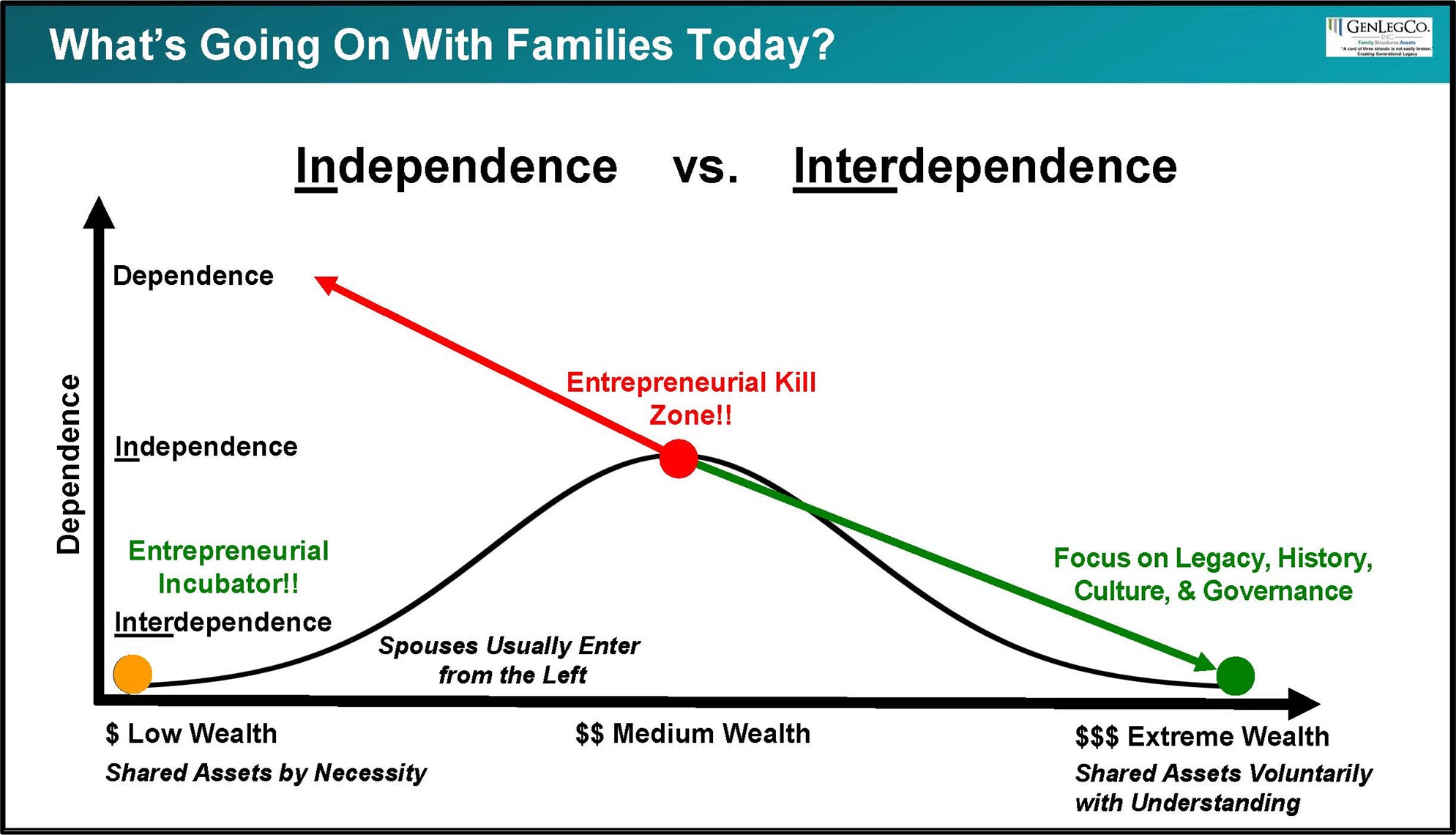

› Only 10% of families enjoy multi-generation success. 90% fall victim to the proverb “Shirtsleeves to shirtsleeves in three generations.” The successful 10% engage in activities like regular family meetings, preparing their heirs to be responsible inheritors.

› Typically, the patriarch and matriarch (Generation 1 or “G-1”) pay for these activities and make sure they happen. The problem is that after the patriarch and matriarch are gone, the children drop the ball and don’t want to pay for these activities or take the time to do them. It takes more than G-1’s hopes and dreams for future generations to succeed. Hope is not a strategy. G-1 needs to be intentional and implement a practical solution.

› G-1 should create a Family Advancement Sustainability Trust (“FAST”) to endow the cost of conducting regular family meetings, travel, and enrichment activities.

› A FAST is an add-on to a traditional estate plan, often funded with life insurance.

› A FAST provides FUNDS. A FAST is the best way to pay for best practices of successful families, such as:

• Holding family meetings and retreats.

• Creating curriculum and educating heirs to become responsible inheritors.

• Establishing system of family governance.

• Working to preserve family’s history and heritage.

• Training future generations on concepts like philanthropy and entrepreneurship.

› A FAST provides LEADERSHIP.

• Creates a leadership structure to ensure these activities happen, using a system of trustees and committees who are paid to run the FAST and charged with the responsibility for carrying out these tasks.

› A FAST can act as replacement “glue” to help bind the family together after G-1 is gone.

› James Grubman (Family Legacy expert) uses a football analogy to perfectly illustrate the issue:

• Think of a football game. The focus is on the quarterback. The quarterback has perfect throwing skills. The football (the inheritance) is perfectly thrown to receivers at the other end of the field. But, no one has prepared the receivers. They’ve never been to a practice. As the ball comes their way, the receivers don’t know how to catch it or what to do next if they do catch it. They don’t know how to coordinate with each other as team players. What are the odds the receiving team will catch the ball and carry it down the field, without fumbling it, to score a touchdown? A family with unprepared and disconnected heirs almost always “drops the ball.”

• The Family Advancement Sustainability Trust is the vehicle to make sure the heirs are prepared when the football comes their way.