Our family’s annual pilgrimage to the Berkshire Hathaway Annual Meeting includes an early Saturday ritual. Those wishing to ask Warren Buffett and Charlie Munger a question head to a lottery drawing. The few holders of winning tickets get the opportunity. This year was my third time to get lucky and be chosen to ask a question.

Ten years ago, my son Adam convinced me to enter the lottery for the first time. I had beginner’s luck. My first question to Buffett was about his estate plan, seeking an answer to his famous thesis: “I want to leave my children enough so that they can do anything, but not so much that they can do nothing.” I asked: “How much is that?”

Buffett answered: “I think that more of our kids are ruined by the behavior of their parents than by amount of the inheritance. Your children are learning about the world through you and more through your actions than they are through your words. From the moment they’re born, you’re their natural teacher. And it is a very important and serious job, and I don’t actually think that the amount of money that a rich person leaves to their children is the determining factor at all. In terms of how children turn out, I think that the atmosphere, and what they see about them and how their parents behave are more important.”

Two years later at the 2015 Annual Meeting, I got lucky again. Sticking with the subject of estate planning, my second question to Buffett was about the role of philanthropy in his estate plan, including his decision to sign Bill Gates’ “Giving Pledge.” I said: “Today, I’d like to ask about your decision to sign The Giving Pledge, promising to give away at least one-half of your assets to charity. Can you talk about your views on philanthropy and how to balance leaving an inheritance to your family versus assets to charity?”

Buffett’s answer was: “Well, that depends very much on the individual situation, and actually I’ve promised to give over 99% in my case, but that still leaves plenty left over. …So the question is, ‘where does it do the most good?’ And, I think limited amounts do some real good for my children, so I’ll be sure that they have that or they already have it to a degree. And on the other hand, when I look at a bunch of stock certificates in a safe deposit box that were put there fifty years ago or so, they have absolutely no utility to me. Zero. They can’t do anything for me in life. …So, here these things are that have no utility to me, and they have enormous utility to some people in other parts of the world. They can save lives. They can provide vaccines. They can provide education. They have all kinds of utility. So why in the world should they sit there for me or for some fourth generation of great-grandchildren or something when they can do a lot of good now? So that’s my own philosophy on it. But I think everybody has to develop their own feelings about it and should follow where they go. I do think they might ask themselves ‘where will it do the most good?’”

At the following year’s Annual Meeting and each one after that, I continued entering the lottery with no success, until this year. This year, my ticket number was “18,” and I knew it was going to be my day. Eighteen is my lucky number. In Hebrew, the number 18 is represented by the letters Chet (8) and Yud (10), which spells the word “chai,” the Hebrew word for “life.” Upon receiving ticket 18, I thanked the lottery guy and assured him it was my year to win. As I predicted, the number drawn was indeed “18,” and my adrenaline started rushing.

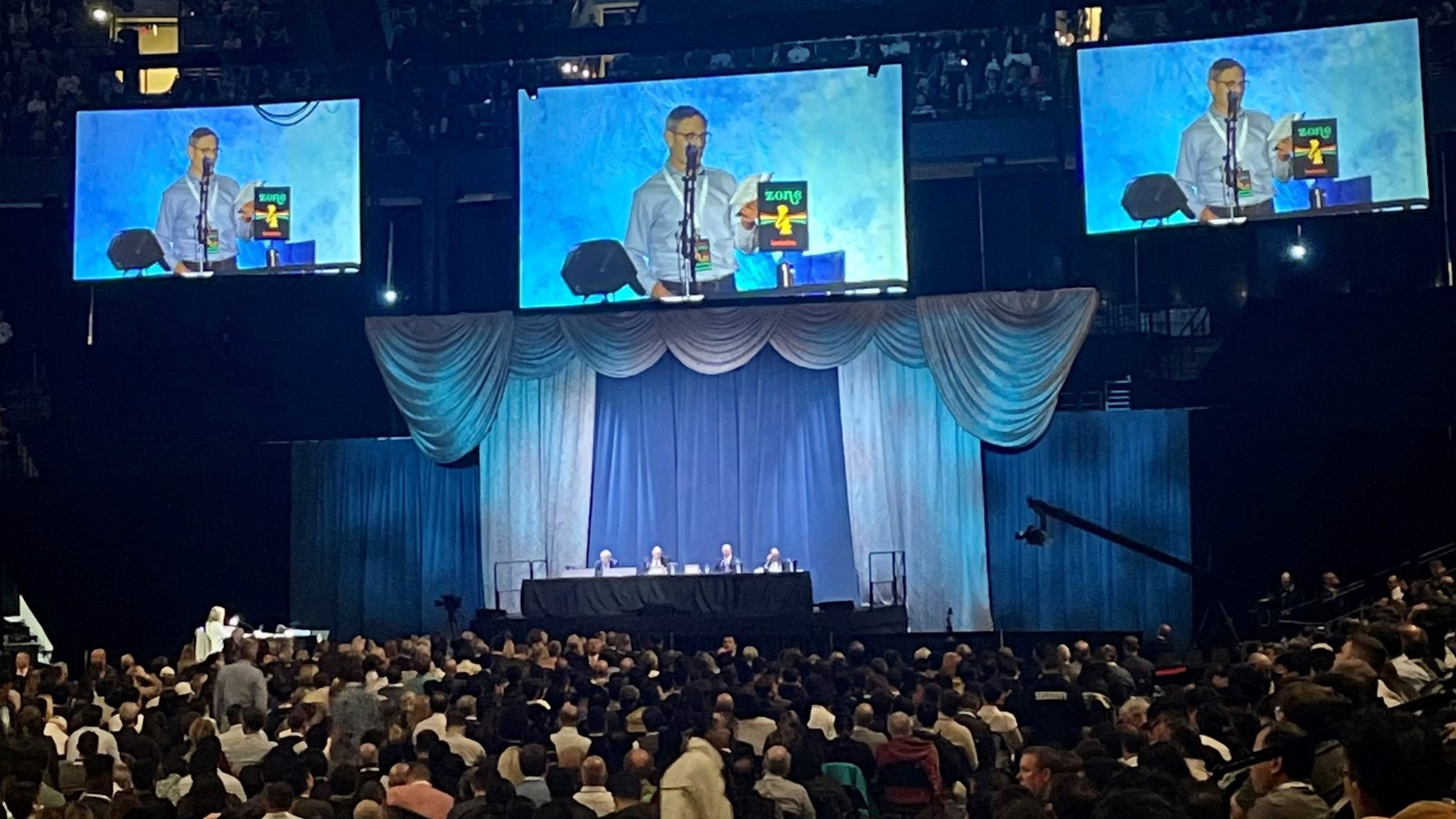

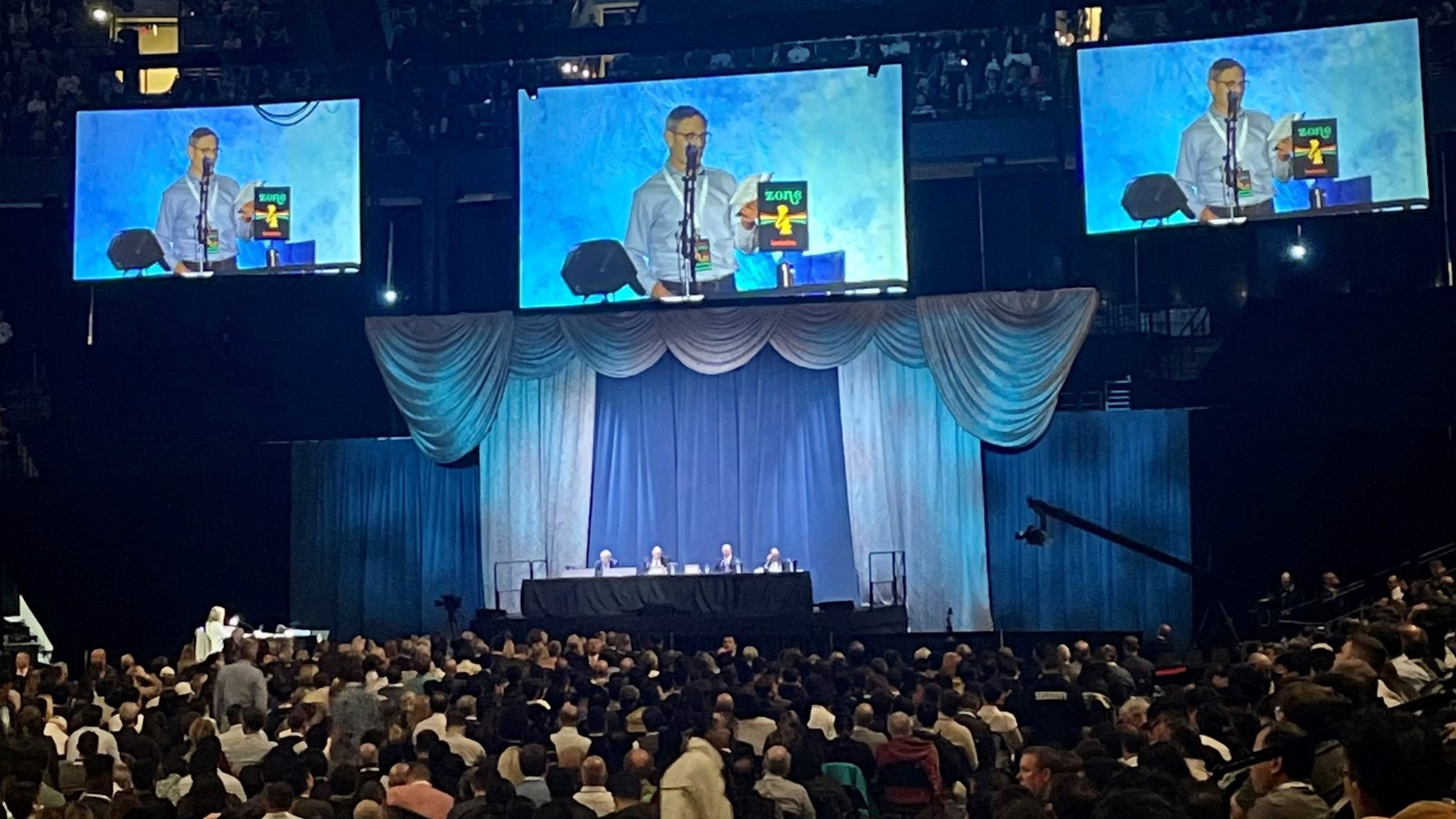

It is intimidating to stand in the spotlight in a room of some 50,000 people, with cameras rolling on live CNBC TV coverage and hear your voice echoing and reverberating as you nervously power through your question. While asking, I was twice interrupted with applause, boosting my confidence. My question this year continued the estate planning theme, focusing on preparing heirs for an inheritance. Even before I finished my question, Buffett jumped in to answer, eager to weigh in. He and Munger then spoke eloquently for more than seven minutes, providing a master class in Family Legacy Planning, my estate planning passion. I am gratified and honored by their enthusiastic response.

Here’s a summary of Buffett’s response to this year’s question as reported by Yahoo Finance: “Responding to a question from an estate planning attorney [Marvin Blum], Buffett said it was imperative to include your heirs in your estate planning. According to Buffett, if the first time children are hearing about the thoughts and wishes of the deceased [parent] is when they read the will, the parents have made a terrible mistake. Buffett went on to suggest that if you intend your heirs to act responsibly and ethically with your bequest, it’s important that you live the ideals you want to pass on to them.”

This year’s “Woodstock for Capitalists” meeting coincided with the coronation of King Charles III, the new monarch of the United Kingdom. Buffett had earlier teased that we had our own King Charles—“King” Charlie Munger. I tied into the other King’s crowning, citing then Prince Charles’ tutelage as the ultimate example of preparing an heir to take over the family kingdom. To use a Texas idiom, Prince Charles “rode around in the truck” (or should I say “carriage”) with his “mum” for more than 70 years, observing and learning from Queen Elizabeth’s commitment to duty and service. Let’s draw inspiration from the British Royal Family and follow advice from Berkshire’s royalty to prepare our heirs for the inheritance coming their way. Long live the Kings, both King Charles III and “King” Charlie Munger, now 99 years old, going strong and as sharp as ever.

Each of my three questions at the Berkshire Hathaway Annual Meetings generated significant media coverage. The press is evidently eager to hear the “Oracle of Omaha’s” wisdom on estate planning, a welcome break from all the questions about investing.

- Information on the media coverage of my questions to Warren Buffet over the years is available here.

- A transcript of the Q&A for this year’s question, including Buffett’s complete answer, is available here.

- CNBC was the exclusive host of this year’s meeting. My exchange with Buffett is available as part of CNBC’s recording of the morning session available here, beginning at the 56:24 mark.

- A transcript of my 2015 question and Buffett’s complete answer is available here.

- A transcript of my 2013 question, along with Buffett’s complete answer and the subsequent discussion is available here.

In the words of Tevye in Fiddler on the Roof and symbolic of my lucky “chai” 18, “To life, to life, l’chaim!”

Marvin E. Bum

All eyes were on Marvin Blum at the 2023 Berkshire Hathaway Annual Meeting as he poses a question to Warren Buffett and Charlie Munger, the third year Blum was selected as one of the attendees chosen to ask a question.