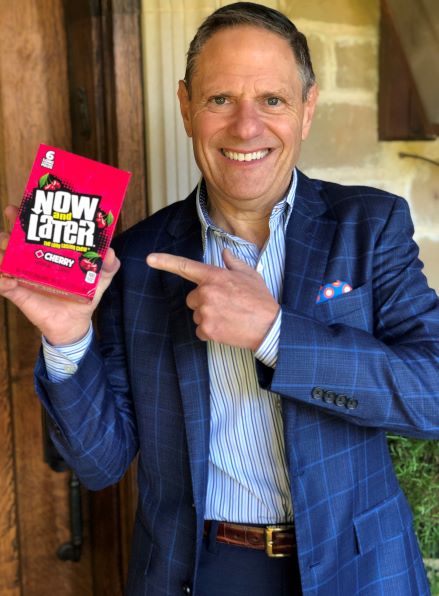

As discussed in the last two Family Legacy Planning emails, families struggle with balancing the amount to leave their kids versus the amount to leave to charity. As you settle on the amount to give your kids, the question becomes “When should I give it?” In giving assets to your kids, think about the benefits of providing some of the money to them now versus waiting until your death to leave it all to them. Consider the “Now & Later” candy approach to inheritance:

- They very likely will need it more now, in their earlier years of raising a family, than they will down the road.

- You will be here now to help guide and mentor them.

- You will have the satisfaction of seeing them benefit from your generosity.

- By spreading out the inheritance and starting now with smaller sums, your kids can learn from smaller mistakes and fare better later with larger sums.

- A gift now sends a message that you trust them, building confidence and pride that they are part of your family’s success story.

The timing of this topic ties in perfectly with current developments in tax law. If it passes, the Biden “Build Back Better” legislation greatly limits the tools available for making lifetime gifts:

- The lifetime exemption cuts in half on January 1, 2022 (just over 2 months from now), cutting back lifetime tax-free gifts from $11.7 million to $5.85 million.

- After the “Date of Enactment,” you can no longer use IDGTs (Intentionally Defective Grantor Trusts), traditional SLATs (Spousal Lifetime Access Trusts), or GRATs (Grantor Retained Annuity Trusts) to get assets out of your estate.

- After the “Date of Enactment,” you can’t make gifts to old IDGTs, SLATs, or any other Grantor Trusts (including most ILITs—Irrevocable Life Insurance Trusts) and get those assets out of your estate.

- The opportunity to do “squeeze” planning with valuation discounts goes away on the Date of Enactment.

Now is the ideal time to think about gift planning for your family, for both tax reasons and non-tax reasons. At The Blum Firm, we are honored to help you evaluate your gifting options.

Marvin E. Blum

Marvin Blum advocating for a “Now & Later” approach to inheritance.