In this weekly Family Legacy Planning series, I have often stressed the importance of a Family Mission Statement. Knowing who you are and what you stand for anchors a family. A succinct and memorable mission statement gives family members a core and connects them with each other.

In past posts, I have shared that the Blum Family Mission Statement includes the values of relationships, memorable moments, and spirituality. Our trip to Israel a few weeks ago checked every one of those boxes. We connected with family & friends who live in Israel. We made lifetime memories with our daughter Lizzy, her husband Ira, and their 3 kids. But today I want to focus on the spiritual aspect of the trip.

In the article “How to Make Life More Transcendent” in The Atlantic, Arthur Brooks endorses the importance of building spiritual moments into our lives. “Spiritual experiences—traditionally religious or otherwise—give us unique insights into life and positive benefits we simply can’t get elsewhere . . . . People often engage in religious and spiritual behaviors because they want to understand life’s meaning in a confusing world.” Given that our wondrous trip ended with a vicious attack aimed at destroying Israel, Brooks’ words ring truer than ever. Indeed, I look back on the spiritual insights we gained to try to make some sense of this very confusing world we now inhabit. I refuse to allow terrorists to rob me of the spiritual “sense of awe, a feeling of oneness with others or the divine” that Brooks describes.

We were in Israel during the week of Sukkot, the Feast of Tabernacles, a holiday celebrating the harvest and the miraculous protection G-d provided the children of Israel when we escaped slavery in Egypt. Sukkot begins five days after Yom Kippur. It culminates with Simchat Torah, the day when we complete the one-year cycle of reading the Torah. This time of year is the holiest few weeks in the Jewish calendar. Sukkot is the most popular time of year to be in Israel. The country is literally packed with visitors from around the world. Celebrating while feeling a physical connection to the land of our Biblical roots heightens the spiritual experience.

For Jews, the holiest site in the world is at the Western Wall in the Old City of Jerusalem, a section of the wall that surrounded the Holy Temple. That portion of the wall remains after the Temple was destroyed in the year 70 C.E. Prior to Israel’s victory in the Six Day War of 1967, Jews were deprived access to the Wall and the holiest areas of Jerusalem. Regaining access to those sites is one of the highlights of my lifetime. Upon reclaiming the holy city, Israel renamed the Wall from the “Wailing Wall” to the “Western Wall,” a tribute to the end of an era of wailing and longing for that return. A highlight of any Israel journey is to pray at the Western Wall. As the attached photo shows, we went to the Wall immediately after my 3-year-old grandson Ollie’s upsherin (first haircut) to praise G-d for this new chapter in Ollie’s life.

We returned to the Wall a couple of days later for another spiritual highlight. There are only two days each year when there is a mass gathering at the Wall called Birkat Kohanim (the Priestly Blessing), once during Sukkot and once during Passover. On those days, thousands upon thousands of Kohanim (Jews who descend from Moses’ brother Aaron, whose sons served as priests in the Holy Temple) congregate at the Wall to deliver the blessing. We were honored to witness the religious service from a rooftop balcony overlooking the Wall, a memory that is now forever woven into the fabric of our family.

It is not lost on me that Hamas’ surprise attack came on one of our most religious days of the year. The goal of catching Israel off-guard conjures up painful memories of the last surprise attack, 50 years ago to the day, the Yom Kippur War of 1973. I remember receiving the news while praying in our synagogue that Egypt and Syria invaded Israel on our holiest day of the year. It is also not lost on me that the October 7 attack came at a time when the country was jam-packed with visitors, the busiest tourist season of the year. The timing only adds to the brutality of the invasion. All airlines except the Israel-owned El Al immediately ceased operating. Many of those tourists are still trapped in Israel.

As part of my spirituality, I believe in miracles from heaven. Indeed, our trip brought us a series of miracles, both large and small. On the small end, the trip began with a miracle arrival at the King David Hotel in Jerusalem. Lizzy’s family flew to Israel a few days before Laurie and me so they could enjoy some time on the beach in Tel Aviv. We never discussed what time we hoped to arrive at the King David Hotel, aware that there were too many unknowns to predict an arrival time with any accuracy. Our car drove up to the hotel front door, and as I exited the car, a car pulled up behind me and I heard shouts of “Zaidy!” from my grandkids’ voices. Without any effort to coordinate, we arrived at exactly the same moment. Another miracle is that Laurie and I happened to leave Israel on one of the last American Airlines flights before air service ceased, arriving home only hours before the attack. Otherwise, we might still be there trying to get home. Miracle three is that Ira had booked their flights on El Al, even though more expensive, in order to support Israeli businesses. Because of that miracle, they were booked on a flight leaving two days after the attack on the only airline still operating. Otherwise, they might still be trying to get home.

But the biggest miracle of all is the way that Lizzy’s family managed to escape and return home safely. After spending time on-and-off in bomb shelters during their final two days, they made the harrowing journey from Jerusalem across Israel to Ben Gurion airport near Tel Aviv, risking terrorist attacks along the way. Laurie and I breathed a sigh of relief when Ira’s text arrived that they made it to the airport, got through security, and boarded the plane. Just then, news reports announced that Ben Gurion Airport was under attack, with missiles coming in from Gaza. The airport went into lockdown, but they were stuck on the plane, grounded. Laurie and I prayed and paced, then the biggest miracle occurred. We learned that the El Al pilots, trained in the Israel Air Force, turned off all lights outside and inside the plane, closed all window shades, shut down all internet communication, and took off just after midnight on a darkened runway, flying north to Haifa instead of west, and circling around until the plane was safely over the Mediterranean Sea. At that point, we received the best text of our lives from Lizzy, informing us the lights were back on and they were out over the water, safe from attack. How do you spell R-E-L-I-E-F? Laurie and I collapsed with thankfulness to G-d for this miracle.

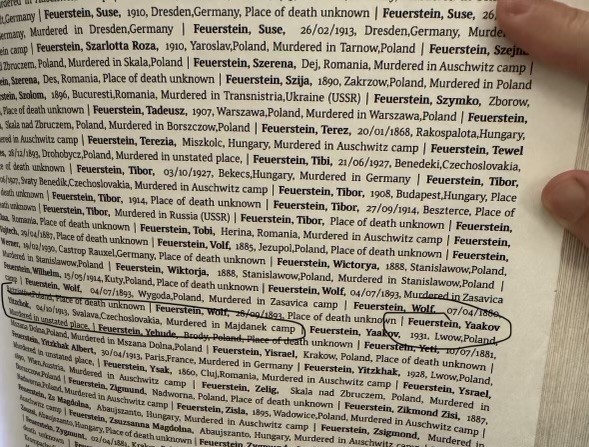

In the Book of Esther, G-d placed Queen Esther in her role to save the Jews “for such a time as this: for if you remain silent at this time . . . you and your father’s family will perish.” When Lizzy’s plane landed, she was directed straight to a television studio for two live interviews on national news shows. She has since been on ten more national and international telecasts, along with giving numerous speeches in New York, as well as Montreal and St. Louis. More speeches and TV appearances are coming. Lizzy’s spirituality has generated a calling in her to become one of the strongest voices in the world to support Israel and fight against anti-semitism. It brings me immeasurable gratitude to see our family’s focus on spirituality carried on to the next generation, and we can already see that Generation Two is passing down that legacy to Generation Three. As we say in Hebrew, L’dor Vador, from one generation to another.

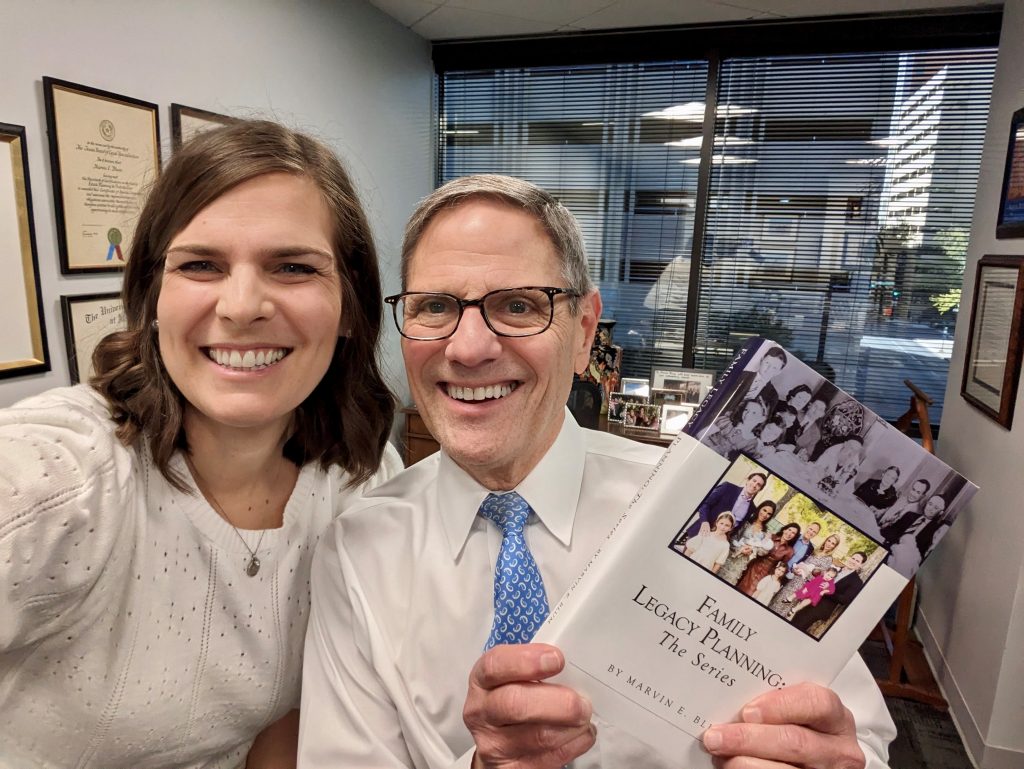

Marvin E. Blum

(For news coverage of the family’s escape from Israel, click on this link for a radio interview with Marvin Blum and on this or this link for an article in the Fort Worth Star-Telegram.)