This post in my Family Legacy Planning series continues to shine a light on Business Succession Planning. Most of the business succession stories covered in the media involve mega-sized family-owned businesses: NFL teams, major chain stores, media empires, huge conglomerates. We’ll get to those later, but first, let’s come back to earth. Most family businesses are small, yet succession planning is as vitally important to that family as it is for the mega business owners.

I can relate to small business owners. I grew up in such a family. In our home, Blum’s Café was like another family member. It was as if my parents had three children: Irwin, me, and the business. Dinner conversation focused on how business was that day. The opening line at the dinner table was always “How was gesheft (Yiddish word for business) today?” Everyone worked in the business.

As is typical, the business started out small. My father opened an industrial restaurant in Fort Worth’s meat-packing district when I was an infant. Growth was slow and organic, often driven by the need for more money.

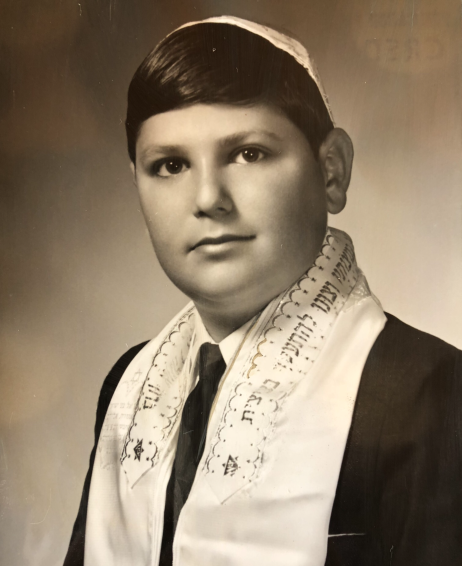

As my Bar Mitzvah was approaching, my parents wanted to build up a fund to pay for it. How did they do it? They put in a jukebox—5 cents per song! They literally grew my Bar Mitzvah fund one nickel at a time. When my mom called my dad early in the day before she arrived to be cashier, if music wasn’t playing, she’d say: “Julius, go put a nickel in the jukebox and get the music going.” It worked. I had a first-class Bar Mitzvah, and 55 years later I still cherish the memories.

As college was approaching for Irwin and me, my parents were even more ingenious. The meat-packing workers all wore white frock coats, which by day’s end were literally covered in blood. To pay for college, my parents started a frock rental business and installed a laundry. All the area employees started their day in our café to rent a frock (and hopefully buy breakfast while they were at it.) The profits paid for all of our University of Texas expenses, allowing Irwin and me to graduate debt-free.

When a need arose, I learned early on that you go to work to make it happen. Julius Blum trained us: “The only helping hand you need is the one at the end of your own arm.” His other motto was: “If you take care of your business, it’ll take care of you.” I’m a believer.

After college, Irwin joined the business full-time and expanded the café operation into J. Blum Co., a full-blown meat-packing supply business. As I’ve recounted in previous posts, Irwin was running the business single-handedly after my father died and my mother retired. When Irwin died unexpectedly two weeks after his pancreatic cancer diagnosis, our succession solution was mom Elsie. (See post from March 1, 2022 “Business Succession Planning: Not Every Family Has an Elsie.”) My mom emerged from retirement in her mid-80’s to run the business and fully manage the transition.

As an estate planning lawyer, Irwin’s death was a wake-up call for me. I’m now a major advocate for business succession planning. We were fortunate to have Elsie as a business transition solution, but don’t depend on luck. The smarter approach is to have a succession plan in place, ready to activate when the time comes. And as I learned, that time can hit you completely out of the blue.

Marvin E. Blum

Blum’s Café installed a jukebox to pay for Marvin Blum’s Bar Mitzvah, one nickel at a time.